Asia to drive the growth of the financial services industry

The centre of gravity of the financial services sector is shifting rapidly towards Asia, with traditional centres such as London losing out to new hubs in Singapore, Shenzhen, Hong Kong and the United Arab Emirates. Adrian Ashurst, CEO of Worldbox Business Intelligence, explores the key drivers of this trend, which include changing geopolitics, the relative decline in wealth of the UK and Europe, and the rise in the economic power of Asia.

Edward Sornio

1 day ago

"London is the financial Jurassic Park"

Back in 2022, the UK hedge fund boss Sir Paul Marshall declared that London was becoming a financial "Jurassic Park", full of old-fashioned businesses - and that it was failing to attract the world's fastest-growing companies, with many preferring to list on the New York, Shanghai and Amsterdam exchanges. Yet despite the subsequent implementation of a sweeping set of measures - the Edinburgh Reforms - aimed at the UK's financial services sector, the decline continues.

Indeed, in July, the Confederation of British Industry (CBI) warned that the exodus of firms from the London Stock Exchange has created a "pivotal moment" for the UK's financial services sector, which requires urgent action. 1 The CBI said that lighter regulation, better marketing and incentives for investors to put cash into British firms were needed to stem the outflow.

However, London's relative decline may now be unstoppable, given the rise of new centres such as Dubai and the continued growth of Singapore and Hong Kong. That partially reflects the growing wealth to be found in Asia, where economies continue to expand rapidly while the UK and European economies stagnate.

The rise of the United Arab Emirates

Dubai and Abu Dhabi are growing fast as financial centres as they strive to diversify their economies away from energy exports. Their appeal is underpinned by a need to manage the vast wealth of sovereign funds and families. Abu Dhabi's sovereign wealth funds, for example, have over US$2 trillion of capital, while Dubai has over US$3 trillion in assets.

Abu Dhabi Global Markets (ADGM) still lags Dubai, but the number of firms registered in the centre rose by 32% in 2024, according to a July 2025 Reuters report, with the amount of assets managed in the centre growing by 245%. BlackRock, Morgan Stanley, AXA, PGIM and the hedge fund Marshall Wace all set up or registered funds in Abu Dhabi last year. 2

Officials expect the rapid pace of the expansion to continue. Reuters quoted ADGM's Chief Market Development Officer, Arvind Ramamurthy, as saying "we still have very strong growth", adding that the pipeline of new firms looked strong for the rest of the year. New operating licences increased by 67% in the first quarter of 2025, bringing the total number of firms operating in the ADGM to 2380.

Booming Dubai

Meanwhile, a record number of new firms set up operations in the Dubai International Financial Centre (DIFC) in the first half of 2025. The total number of active businesses registered in the DIFC now stands at 7700, up from 6153 in the first half of 2024 - a 25% year-on-year increase. There are 47,901 financial professionals working in the DIFC, which is home to 440 wealth- and asset-management businesses and more than 85 hedge funds, up 72% from 50 in June 2024. 3

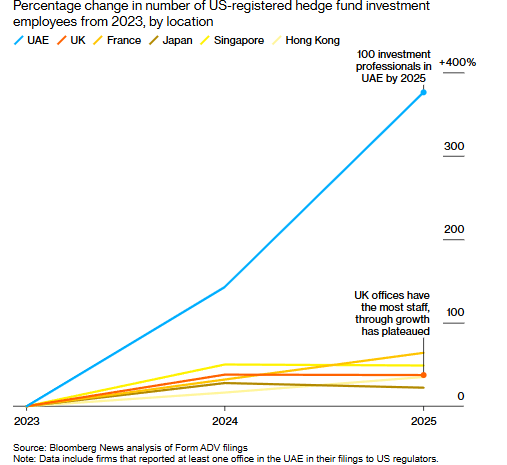

The absence of income and capital gains taxes is among the attractions of the DIFC and the ADGM. Bloomberg has even reported that key personnel are pressing their employers to move to the centres to take advantage of the zero income-tax rate. 4

UAE Hedge Funds: Smaller Staffs but Growing at Fastest Rate

Source: https://www.bloomberg.com/news/articles/2025-06-18/

uae-hedge-fund-traders-are-pushing-firms-into-dubai-abu-dhabi

Sino-US tensions power Hong Kong's recovery

Further to the East, Hong Kong and Singapore are already well-established financial centres that continue to grow rapidly. Hong Kong has bounced back from the strict Covid lockdowns and the political unrest that saw some financial professionals emigrate from the territory, many going to Singapore. Indeed, it has maintained its position as the world's third leading financial centre, after New York and London, 5 despite dire predictions from some quarters.

In February 2024, for example, former Morgan Stanley Asia chairman Stephen Roach declared that "Hong Kong is over". That statement followed four years of declines in the Hang Seng Index and the news that, in 2023, Hong Kong's initial public offering (IPO) ranking fell to sixth place globally, behind India and Indonesia.

By August 2025, however, the Hang Seng had surged by over 50% from the levels seen in January 2024, fuelled by a surge of capital inflows, while Hong Kong reclaimed the top spot in the global IPO rankings, with nearly HK$90 billion raised in the first half of 2025. 6

In June, Roach admitted that he had been wrong. He told Bloomberg: "What's changed is, shockingly, the US-China conflict has gotten worse and Hong Kong—rather than getting hammered in the cross fire as I expected and wrote—may be benefiting from that, because of its unique position as China's most important window to international finance." 7

Hong Kong has in fact widened its lead over Singapore, and has closed the gap with top-ranked New York, according to the latest edition of the Global Financial Centres Index. Hong Kong's overall rating increased by 11 points, while Singapore gained three points to stay fourth worldwide. 8

Singapore focuses on key areas

Singapore performed strongly in four of the five areas of competitiveness evaluated by the Global Financial Centres Index. The city state ranked fourth in business environment, human capital, infrastructure, and reputational & general factors, while securing fifth place in financial sector development. 9

Just as Hong Kong draws strength from its role in helping to manage the vast wealth of mainland China, so Singapore serves the increasingly wealthy Southeast Asian region. It does, however, face challenges as countries like Malaysia strive to develop their financial centres and Hong Kong fights back.

Singapore is responding by focusing on four key areas:

FinTech and digital banking expansion: Already a leader in payment innovation, digital banking and digital asset management, Singapore continues to innovate. In 2024, for example, it focused on linking its real-time payment system, PayNow, with neighbouring countries. Instant payment linkages, including QR code-based transactions, are now operational between Singapore and Malaysia, Thailand and Indonesia, enabling seamless payments across borders.

Sustainability and green finance: The central bank has launched a number of initiatives designed to position the country as a regional hub for green finance, ESG investment, and carbon services and trading.

Wealth management: Singapore has established itself as one of the leading private banking and wealth-management centres within Asia and globally. The city state's sound financial regulation, strong rule of law, and political and economic stability attract high-net-worth individuals. Singapore is the second most competitive international wealth-management centre globally, according to Deloitte International's Wealth Management Centre Rankings 2024. It is also home to 2000 single family offices.

ASEAN financial integration: Singapore leads the Association of Southeast Asian Nations' (ASEAN) financial integration efforts, ensuring its continued role as a regional financial gateway. Speaking on the issue of US tariffs, foreign minister Dr Vivian Balakrishnan said in July 2025 that ASEAN must make sure it removes every internal tariff and non-tariff barrier, and optimises its competitive position.10 11

The Asian economies are likely to continue outpacing the US and Europe for the foreseeable future. In its April 2025 World Economic Outlook, for example, the IMF forecast that emerging and developing Asia would expand by 4.5% and 4.6% in 2025 and 2026 respectively, compared with growth of just 1.8% and 1.7% for the US and just 0.8% and 1.2% for the euro area. 12

In January 2025, S&P Global predicted that the Asia-Pacific region will account for 42% of global GDP by 2040, up from 37% in 2021. The rise will be underpinned by the economic expansion of mainland China, India, and the ten Southeast Asian countries comp --->rising ASEAN. 13 Inevitably, this will drive a further huge increase in wealth - and with it, demand for financial services, further fuelling the rise of the likes of the UAE, Hong Kong and Singapore.

Sources

- 1 https://www.bbc.com/news/articles/cz6g85qp0p6o

- 2 https://www.reuters.com/world/middle-east/abu-dhabi-expects-more-rapid-growth-its-financial-centre-2025-06-10/

- 3 https://www.difc.com/whats-on/news/difc-records-best-ever-performance-for-the-first-half-of-a-year

- 4 https://www.bloomberg.com/news/articles/2025-06-18/uae-hedge-fund-traders-are-pushing-firms-into-dubai-abu-dhabi

- 5 https://laotiantimes.com/2025/03/20/hong-kong-world-no-3-global-financial-centre/

- 6 https://www.thinkchina.sg/economy/hong-kong-makes-comeback-international-financial-centre

- 7 https://www.bloomberg.com/news/articles/2025-06-02/stephen-roach-now-says-it-s-too-early-to-declare-hong-kong-over

- 8 https://www.longfinance.net/programmes/financial-centre-futures/global-financial-centres-index/gfci-37-explore-the-data/gfci-37-rank/

- 9 https://sbr.com.sg/economy/news/singapore-retains-4th-place-in-global-financial-centres-index

- 10 https://www.thestar.com.my/aseanplus/aseanplus-news/2025/07/12/asean-must-double-down-on-economic-integration-to-withstand-external-pressures-says-singapore-minister

- 11 https://www.aseanbriefing.com/news/singapores-role-as-aseans-financial-hub-can-it-maintain-its-lead/

- 12 https://www.imf.org/en/Publications/WEO/Issues/2025/04/22/world-economic-outlook-april-2025

- 13 https://www.spglobal.com/market-intelligence/en/news-insights/research/ascent-of-apac-in-the-global-economy